Financial insurance provider marketing companies hash out dull advertising. See how one advertising company creates a financial advertising and marketing suggestion created to knockout typical insurer settlement.

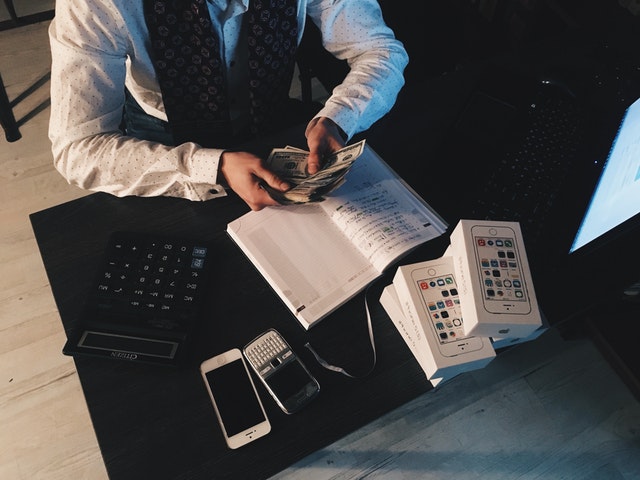

Browse a monetary or insurance sector professional publication and also concentrate on the advertisements. Insurance advertising and marketing firms complete for brokers with emphasis on financial compensations. One financial insurance company pays 75% for a term life insurance policy. For another business, payments hit 80% payment. Not to be surpassed a 3rd offers a monetary reward of 90% commission for marketing that insurance provider plan. This very same practice is provided for financial insurer competitors of annuities.

With the life insurance policy intends the marketing firm advertises, seldom are the renewals stated. For that reason, a company that pays 5% greater compensation the first year, and could pay revivals at a 5% lower price the 2nd year. You would certainly assume that economic insurance provider execs would certainly understand that several brokers change the business they created the very first year for financial reasons. Then the broker once more obtains a high initial year settlement versus a lowly renewal charge.

Home Casualty insurance provider settlement planners established a strategy that inhibits changing the business you created with another service provider when it comes up for renewal. A creating representative generally gets a commission of 15% to 20% on the car and homeowner plan they write. Next year the exact same insurance company once more pays 15% to 20% for the second year’s costs. The incentive for an agent to advertise and market a brand-new business to this client makes no feeling.

Life and monetary insurers marketing life insurance policy strategies have little reason for not re-evaluating their 100 years of age system of very first-year commissions and also following year revivals. This is especially real when you think about how many life insurance policy cases are paid within the initial 2 plan years compared to auto and house insurance. Greed by the insurer triggers a domino effect to the agent or broker to also get greedy for their individual economic factors.

Ultimately I assessed an ad by a relatively unknown to me, an insurance company advertising and marketing company. The company had a financial score of “A” and also not “A+” which to a manufacturer watching current financial turmoil is immaterial. The advertising and marketing captured my eye with two excellent suggestions. They were doing the uncommon method of having agents monetarily offer the middle-class market. Nearly every rival focuses on marketing to the affluent market. The bullseye nonetheless was the payment strategy.

A financial marketing idea that struck dead center was an insurance provider not complying with the other lamb, but wanting to be ingenious. Composing a competitive global life item via this marketing company would certainly generate commissions like no other. The broker would certainly get 80% payment the very first year and also an additional 80% commission the second year. You can bet this insurance company will have really little insurance coverage replaced by another insurance firm in the second year. The economic incentive is so tempting; that I almost forgot that I am an expert and not a qualified seller, so I take down the phone.

I really hope that for the sake of an economic insurance provider advertising and marketing company, more insurance companies will certainly comply with the lead. Unless this advertising was a large misprint, I see it as an unusual win-win-win situation for business, marketer, as well as manufacturer.

Feel free to visit DeepTechy to get more important information.